A zoom in on Danone's 2022 Integrated Annual Report

Danone's latest news

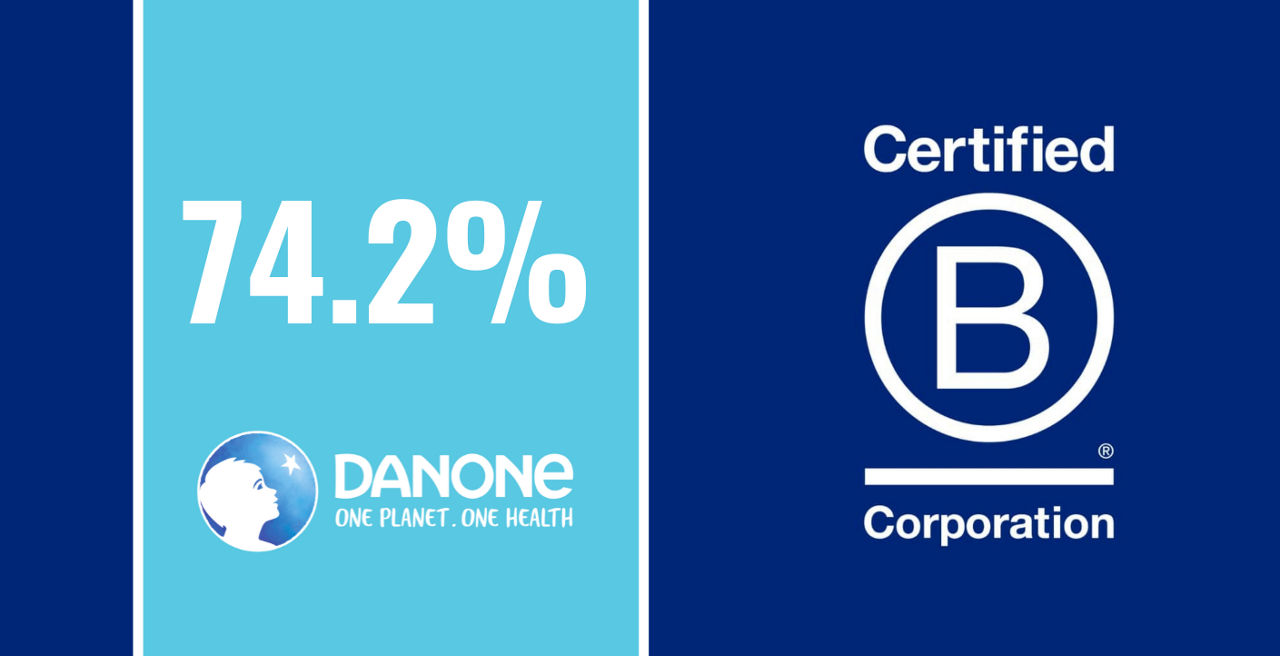

74.2% of our business is

B Corp certified

A zoom in on Danone's innovations

At Danone, we offer products that put people at the heart of everything we do. We pioneer innovative food, drinks & specialized nutrition that can positively impact health.

Check out some of the latest innovations we launched around the world!